If politics is Ajax, then economics must be Cassandra?

If politics is Ajax, then economics must be Cassandra?Is the $800 billion stimulus package too small, as many Democrats claim (such as Paul Krugman), or too big, as most Republicans claim? The answer is yes, too big politically and too small economically. It is too big insofar as it underestimates profitable return from funding support for the banks and too small by being spread over more than 1 year; it won't all get spent in 2009 and most of it not soon enough within the year, but that's just normal practicality of getting plans shaped and approved and the money-spend rolled out - all takes time.

If the criterion is how much annual fiscal stimulus to demand is needed to bring the economy back up to the level of potential output in 2010 and beyond, and to bring the unemployment rate back down to the monetarists' natural rate of unemployment, then $800 billions is not quite enough at 5.7% ratio to GDP. A more effective figure would be $1.1 trillion or 8% ratio to GDP, but that takes it over the psychological "trillion" number that PR people envisage triggering investor panic! The Congressional Budget Office (a depository of Republican neo-con economy spread-sheeters) estimate the economy will fall short of potential output by about 7% of GDP, in both 2009 and 2010.

(As OMB Director, Doug Elmendorf testified on January 27 – ex-Brookings who seems more monetarist than 'fiscalist' see http://www.brookings.edu/experts/e/elmendorfd.aspx.) The news on jobs and other economic indicators since then shows the economy losing air like a pricked balloon, or maybe like a potholer finding the passage-ways getting narrower, or like a bunch of office-workers in a stuck lift that lurches from moment to moment downwards - choose or invent your own claustrophobic metaphor.

(As OMB Director, Doug Elmendorf testified on January 27 – ex-Brookings who seems more monetarist than 'fiscalist' see http://www.brookings.edu/experts/e/elmendorfd.aspx.) The news on jobs and other economic indicators since then shows the economy losing air like a pricked balloon, or maybe like a potholer finding the passage-ways getting narrower, or like a bunch of office-workers in a stuck lift that lurches from moment to moment downwards - choose or invent your own claustrophobic metaphor. The $800 billion will spread over several years; the peak is to be $356 billions in 2010, which is about 2½% of GDP. The most optimistic estimate of the “Keynesian multiplier” that anyone has is 2, implying a 5% boost to GDP. That's below the 7% "gap of gloom", not enough to return the economy onto a path to full employment. The fiscal stance should not be the only impetus. There may be some restructuring of spending, but more important than this will be the push-through effect on the banks of their bailouts and how their 'funding gaps' are refinanced.

Last week's grilling in Washington of Wall Street's CEOs asked them, "why, when banks have received billions of dollars of taxpayers' money, is it harder for people to borrow?" Some bank chiefs said their lending continues - and in some cases has increased. But, reality is that availability of credit is tight and may tighten more.

Critical to this is the Geithner Plan, the scale and details of TALF. The problem of the lack of detail is that TALF is being pulled in several political directions. These are funding as per the Bank of England's SLS example, or towards 'bad bank', or 'insurance cover', or direct payments to bail-out mortgage borrowers on 'Main Street'?

Critical to this is the Geithner Plan, the scale and details of TALF. The problem of the lack of detail is that TALF is being pulled in several political directions. These are funding as per the Bank of England's SLS example, or towards 'bad bank', or 'insurance cover', or direct payments to bail-out mortgage borrowers on 'Main Street'?There is near-total collapse of the private interbank funding market using securities backed by loan assets such as payments on residential and corporate mortgages, consumer credit cards, corporate bonds, student loans, lease-finance loans etc. The straight option is for Government to step in and replace the private sector in interbank lending, and take the profits of that until the private sector clamours at the legislators doors to buy their business back.

The 'funding gap' is the gap between bank customer deposits and bank customer loans. While in the UK in 2008 banks issued a record volume of ABS (£245bn) to swap for treasury bills (£185bn), in the US it was much less. In the UK in 2009 there will be another £250bn swapped, while in 2009 in the USA so far, according to Dealogic data, there has been a mere $2bn of bonds backed by auto loans and student loans. In 2007, before the credit crunch took hold, more than half of the $5.6 trillions borrowed in the US credit markets was financed through ABS. The UK banks' 'funding gap' is £800bn over 3 years (including UK banks' funding gap in US loans), in the USA it is $6-7 trillions (my estimate). See also: http://www.bankofengland.co.uk/publications/fsr/2008/FSR08Octexsum.ppt#1

The 'funding gap' is the gap between bank customer deposits and bank customer loans. While in the UK in 2008 banks issued a record volume of ABS (£245bn) to swap for treasury bills (£185bn), in the US it was much less. In the UK in 2009 there will be another £250bn swapped, while in 2009 in the USA so far, according to Dealogic data, there has been a mere $2bn of bonds backed by auto loans and student loans. In 2007, before the credit crunch took hold, more than half of the $5.6 trillions borrowed in the US credit markets was financed through ABS. The UK banks' 'funding gap' is £800bn over 3 years (including UK banks' funding gap in US loans), in the USA it is $6-7 trillions (my estimate). See also: http://www.bankofengland.co.uk/publications/fsr/2008/FSR08Octexsum.ppt#1Funding gap problems are the essence of the meaning of "credit crunch", but should not be confused with credit risk losses (provisional before actual realised) as in the graphic below that is worth repeating again here.

The Congressional hearings came just as the biggest annual securitisation industry conference ended in Las Vegas (appropriately, where the slot machines are less noisy of late). Numbers attending the American Securization Forum event fell to 3,600 from 6,000 in 2008. The US government knows that securitisation markets remain key to interbank credit, hence it has a plan for the Fed to lend up to $1 trillion to hedge funds and others to buy banks' ABS. This is Term Asset-backed securities Loan Facility (Talf). Last week, the size of the scheme increased from $200bn to $1,000bn as a result of hedge funds lobbying for this. In my opinion TALF could be better kept entirely in-house by the Fed, but it has possibly another $5 trillions of such swaps to do and so engaging the hedge funds for 1 sixth seems sensible enough. Others estimate the US banks' funding gap, at only $2-3 trillions, hence the split between private/public funding looks for now more 50/50. Citi led the way in growing banks' funding gaps after 2003.

The Congressional hearings came just as the biggest annual securitisation industry conference ended in Las Vegas (appropriately, where the slot machines are less noisy of late). Numbers attending the American Securization Forum event fell to 3,600 from 6,000 in 2008. The US government knows that securitisation markets remain key to interbank credit, hence it has a plan for the Fed to lend up to $1 trillion to hedge funds and others to buy banks' ABS. This is Term Asset-backed securities Loan Facility (Talf). Last week, the size of the scheme increased from $200bn to $1,000bn as a result of hedge funds lobbying for this. In my opinion TALF could be better kept entirely in-house by the Fed, but it has possibly another $5 trillions of such swaps to do and so engaging the hedge funds for 1 sixth seems sensible enough. Others estimate the US banks' funding gap, at only $2-3 trillions, hence the split between private/public funding looks for now more 50/50. Citi led the way in growing banks' funding gaps after 2003.  Today, Citicorp has its funding gap mostly covered thanks to its Government deal and therefore it is not too surprising to hear the spoiling comment from Citi director Mary Kane, "The Talf will result in a two-tier market and will not do anything to help traditional, real money investors. This will hinder the recovery of the markets."

Today, Citicorp has its funding gap mostly covered thanks to its Government deal and therefore it is not too surprising to hear the spoiling comment from Citi director Mary Kane, "The Talf will result in a two-tier market and will not do anything to help traditional, real money investors. This will hinder the recovery of the markets."The Banks as borrowers and lenders allowed interbank funding costs (spreads) to get too high to support past business models. But by balking at the deals the result was that panic set in about the banks' funding and the result was a hundred times more was lost in shareholder value (even after discounting for recession impact). Many private investors ('traditional investors' more than hedge funds) continue to balk at buying new issues, even with mouth-watering high yields, partly because of the uncertainty about the new US government plans. Hence the so far negative impact on confidence of Tim Geithner keeping his options open by not pinning down the details. But, the administration has also learned that there is no point in rushing to precise detail only to find that a temporary stock market spike is manna to short term profit-takers and then everyone concludes that the deal hasn't got long term effectivesness!

A survey of 450 of the Securitization conference participants this month in Las Vegas found most do not expect "return to normal" until 2011. Bet-the-odds investors remain concerned about the disconnect between the high income stream from these bonds and their low market price. This is a general rabbit-in-the-headlights problem of looking a gift horse in the mouth, if it seems too good to be true, it is, etc. i.e. how can the near-perfect-information markets so mis-price income-generating assets? Answer is simple - yields change and when capital is scarce yields go up dramatically as asset prices fall - just a matter of knowing some economic history! Investors, nevertheless want some reassurance as to how far defaults (borrower delinquency) can rise, not only of the underlying mortgagees and consumer credit borrowers, but also of loan-brokers, the finance-backing banks and their securitisation vehicle intermediaries (the previously "fail-safe" SPEs and SIVs).

This concern takes the question of this matter on to the effectiveness of the Government's 'fiscal stance' (budget deficit) and monetary 'easing' (zero bank-rate when consumer price inflation is falling). In practice, even if interest rates stay very low, the actual multiplier effect of the government's boost to deficit-spending will be less than 2 i.e. less than 5% boost to GDP. 5% is the figure deemed necessary to return the banks' funding gap to what it was in 2003, to the point when banks competed too hard and too recklessly to gain market share by allowing their funding gaps to ballooon! Much of the fiscal stimulus takes the form of tax cuts, but what % of this will be saved (paying down debt) and not therefore contribute directly to boosting demand by not entering the stream of GDP spending and income. But, of course, banks' customer deposits should rise, if slowly, to add to closing the 'funding gap'. But, the question remains how to stimulate demand that has been lost in the crisis so that jobs are saved, stemming job-losses in the pipeline, and begin creating new jobs (the Obama 5 million jobs target)? And, the part of the tax cut that is another 'one-year AMT patch' will have no effect on spending because the beneficiaries, forecasters, and everyone else assumes they would not be paying this anyway, notwithstanding the 20-year IRS concessions to banks. If we are lucky, the American Recovery and Reconstruction Act will close half of the gap, relative to the yawning magnitude of the recession, but not enough alone to refloat the economy. Hence, we need the banks to do their bit and roll-over domestic lending and expand lending where the wider economic benefits will be greatest.

In another sense, a political one, $800 billions is too much. The 2009 fiscal-year deficit is expected by some calculators to end up at about $1.2 trillion, and if so we're talking deficits thereafter of 10% or higher ratios to GDP - levels that are deemed danger signals in any other country. Until now, the US has not been “any other country.” The trade surplus world has been willing to finance American deficits by buying its bank bonds alongside government treasuries. But while there may be no choice but to continue, the fact is that US imports have slowed dramatically and the pattern of world trade generally is changing dramatically and therefore buyers for new US paper will increasingly need to be domestic not foreign. Foreign countries are all becoming nationalistic about how to apply their capital reserves and therefore international obligations are being settled first on the basis of what domestic financial sectors demand of their own governments. Global banks now recognise that they have to have national homes, the globalised world is not their new country of origin; it has no world government, no central banks, albeit that G20 is running fast to create precisely that in practical terms.

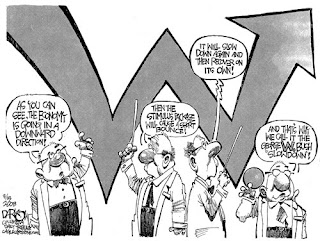

In another sense, a political one, $800 billions is too much. The 2009 fiscal-year deficit is expected by some calculators to end up at about $1.2 trillion, and if so we're talking deficits thereafter of 10% or higher ratios to GDP - levels that are deemed danger signals in any other country. Until now, the US has not been “any other country.” The trade surplus world has been willing to finance American deficits by buying its bank bonds alongside government treasuries. But while there may be no choice but to continue, the fact is that US imports have slowed dramatically and the pattern of world trade generally is changing dramatically and therefore buyers for new US paper will increasingly need to be domestic not foreign. Foreign countries are all becoming nationalistic about how to apply their capital reserves and therefore international obligations are being settled first on the basis of what domestic financial sectors demand of their own governments. Global banks now recognise that they have to have national homes, the globalised world is not their new country of origin; it has no world government, no central banks, albeit that G20 is running fast to create precisely that in practical terms.In that light it is ironic that US politicians who warn against the size of the stimulus bill, the Congressmen who voted against it, are same Republicans who supported the Bush fiscal policies that doubled the national debt via the long-term tax cuts of 2001 and 2003 and that accelerated government deficit spending.

We need now a bigger Obama fiscal policy that maximizes short-run demand stimulus, that gets through to people's pockets who will spend the money, just not save it. Lots of bang for the buck (recovery with jobs), not lots of buck for the bang (jobless recovery). Conservatives/Republicans continue to argue that tax cuts give stimulus while deficit-spending does not - but without an economic theory in support (supply-sider monetarist theories now seemingly discredited); endlessly repeating “tax cut” like the Hari Krishna "OM" mantra, like a cult that believes in the god-given literal truth of the Bible but has no interest in geology or any demonstrable proof. A perfect example of this prudish insanity is Senate Republican Leader, 'Mad' Mitch McConnel saying,"Unfortunately, at this juncture, while the American People are tightening their belts, Washington seems to be taking its belt off!" He obviously doesn't get what "Financial Stabilization" means or what the economic role of Government should be in a recession. The 134 page Budget Report obviously has some reluctant readership among the country's legislators. Obama inherited a 12.5% budget deficit that he wants to cut to 3% by 2013, not in a straight line, but up and over the deep gully of this recession. The Republicans intend to fight this all the way theologically, not constructively or rationally. They are not alone of course; they do have a large constituency of like-minded opinion. What do central bankers think of all this - see comment below for a sample of their political-economy lines.

We need now a bigger Obama fiscal policy that maximizes short-run demand stimulus, that gets through to people's pockets who will spend the money, just not save it. Lots of bang for the buck (recovery with jobs), not lots of buck for the bang (jobless recovery). Conservatives/Republicans continue to argue that tax cuts give stimulus while deficit-spending does not - but without an economic theory in support (supply-sider monetarist theories now seemingly discredited); endlessly repeating “tax cut” like the Hari Krishna "OM" mantra, like a cult that believes in the god-given literal truth of the Bible but has no interest in geology or any demonstrable proof. A perfect example of this prudish insanity is Senate Republican Leader, 'Mad' Mitch McConnel saying,"Unfortunately, at this juncture, while the American People are tightening their belts, Washington seems to be taking its belt off!" He obviously doesn't get what "Financial Stabilization" means or what the economic role of Government should be in a recession. The 134 page Budget Report obviously has some reluctant readership among the country's legislators. Obama inherited a 12.5% budget deficit that he wants to cut to 3% by 2013, not in a straight line, but up and over the deep gully of this recession. The Republicans intend to fight this all the way theologically, not constructively or rationally. They are not alone of course; they do have a large constituency of like-minded opinion. What do central bankers think of all this - see comment below for a sample of their political-economy lines.

1 comment:

Central bankers aren't Gods, just gods, even if a few of them sometimes think otherwise. For proof of their less than mythic proportions one need only survey the various large lapses in judgment, but that's only to be expected except that some might say ill-advised decisions outweighed the brilliant ones. A number of central bankers tell us so. Of course, the private sector made gigantic errors. They would, wouldn't they? In sum, the blame for the current troubles stretches far and wide, high and low. But when it comes to concentrated power, central bankers are a special class. For that reason, listening to their speeches and reading their reports are instructive and productive, and something commercial bankers now rue they did not do more of in recent years — especially on what went wrong.

With that in mind, here are a few choice quotes (courtesy of BIS).

Mario Draghi, governor, Bank of Italy, 16 December 2008 - "One striking aspect of the crisis is precisely how its unfolding has continued to catch both policy makers and private sector players by surprise. It started with defaults in a marginal segment of the financial services industry, then quickly spread to virtually all assets. From being a US-only event, it has become global, and in fact it is forcing and accelerating the redressing of world macro imbalances that have been with us for 15 years. The current recession is the result."

Amando M Tetangco, Jr., governor, Central Bank of the Philippines, 2 February 2009 - "The roots of the US financial crisis can be traced back to the early years of this decade when the United States aggressively eased its monetary policy to facilitate recovery from the dotcom bubble and the September 11 terrorist attacks. If you will recall, the US Federal Reserve began a cycle of cuts in the Fed funds target rate from 6.5 percent in May 2000 to as low as one percent by June 2003. On the fiscal front, large public deficit spending beginning in 2001 was pursued to prop up the economy which was then on the brink of recession. The low interest rate regime fueled a boom in mortgages, including among borrowers with doubtful credit histories or those fancifully called NINJA loans – that is, loans to No Income, No Job or Assets loans. Thus, house prices in the US began rising in 2000, surpassing the growth of disposable income. The excessive lending itself would not have brought in such great financial distress because if the borrowers turned out to be poor borrowers, then foreclosures would just have followed. However, what made this risky behavior turn into a crisis event was the bundling of mortgages by various financial institutions into complex securities such as collateralized debt obligations (CDOs) which were largely unregulated."

Hervé Hannoun, acting general, manager, Bank for International Settlements, 7 February 2009 - "The global financial crisis and its macroeconomic fallout have dramatically changed the agenda of the central banks, fiscal authorities and supervisors and regulators. The change is illustrated by a remark surfacing repeatedly in the current economic debate: “We are all Keynesians now.” In some sense, indeed we are. But history teaches us that, in designing economic policies, policymakers always need to look beyond the short time horizon that crises seem to impose on us. In my view, current expansionary policy responses risk a failure to capture two crucial and interrelated facets of the present crisis. The first is that it is part of an underlying adjustment towards more sustainable macroeconomic conditions. The second is that it is a crisis of confidence which requires a recognition of the rational expectations of economic agents and of the behavioral effects associated with expansionary fiscal policies. To restore confidence in a sustainable way, policy actions should be credible from a medium-term perspective, address existing economic imbalances and pay attention to economic agents’ expectations."

José Manuel González-Páramo, member, executive board,ECB, 6 February 2009 - "The start of the financial crisis was triggered in the summer of 2007 by the realisation that the risks associated with the US market for sub-prime mortgages were not properly reflected in the price of related instruments, particularly mortgage-backed securities. A market-wide reassessment of financial risk led to sharp increases in premia and spreads across all segments of the credit market. The rapidly falling market values of credit instruments hit both the net worth and the profitability of the banking system."

Philipp Hildebrand, vice-chairman, governing board, Swiss National Bank, 5 February 2009 - "Financial markets react to incentives, and these incentives were misplaced in the past. It is in our power to start lobbying for clearly defined and risk-limiting conditions. If the responsible authorities wish to enact more stringent regulation, we ought to give them our unconditional support."

Christian Noyer, governor, Bank of France, 11 December 2008 - "In many respects, the current crisis is about valuation. To be sure, the factors underlying and accounting for the crisis are numerous. However, one of its significant features is that the uncertainty surrounding the “true” value of complex financial instruments has undermined the confidence of global markets, increased uncertainty about counterparty risk and led to contagion across asset classes, financial markets and economic regions. The crisis has highlighted the fact that the valuation of financial instruments is not only a question of accounting. It raises issues about risk measurement and management by financial institutions, prudential issues via the definition of capital requirements and, more widely, financial stability issues. However, valuation is also without any doubt an accounting issue. It is therefore hardly surprising that the debate about the application of accounting standards to financial instruments is a highly topical one."

Jürgen Stark, member, executive board, European Central Bank, 10 December 2008 - "For too many years financial market participants were used to a macroeconomic environment with high global output growth, low inflation and very low interest rates. Macroeconomic policies led to global and domestic imbalances which became increasingly unsustainable with debt financed over-consumption in one region and high savings in other regions. An overall benign macroeconomic environment led to (i) a general carelessness or a tendency to under-price risks and (ii) to a search for yield which in turn accelerated financial innovation."

Lorenzo Bini Smaghi, member, executive board, ECB, 9 December 2008 - "When analysing the current financial crisis the temptation might arise to attribute all the responsibilities to the excesses of the US financial system. I think this would be a mistake. While excessive debt creation and risk mispricing are clearly the root cause of the crisis, we should not forget that in order to make a market you need buyers and sellers. And this crisis is as much a crisis of sellers as of buyers."

For those of you voyeuristically wanting more, there is plenty on all central bank sites worldwide.

Post a Comment